Get paid.Get growing.Get ahead.

Grow your business with PayPal Open and

higher average checkout conversion with PayPal.²

active accounts across 200+ markets to grow your business across borders.¹

higher average order value with Pay Later.³

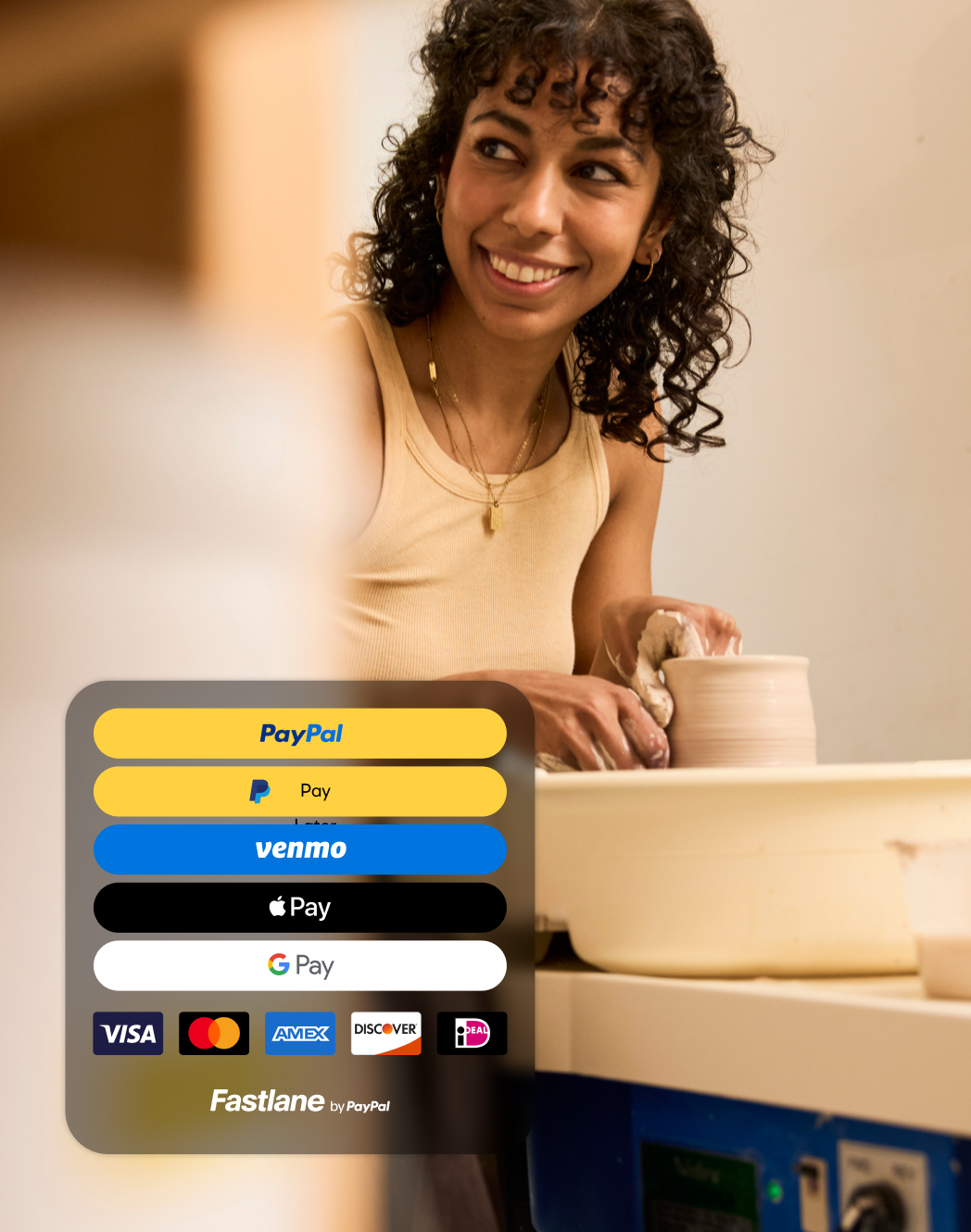

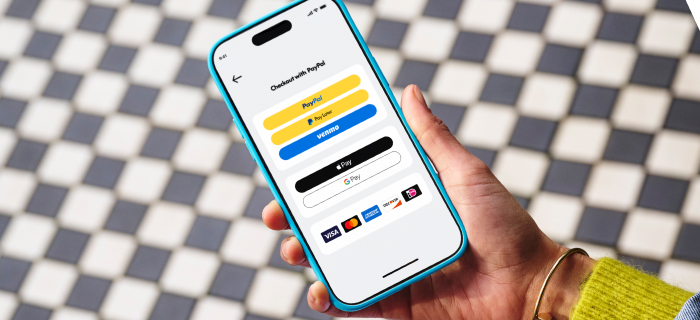

PayPal Checkout.Built to convert.

Drive conversion with PayPal

With 400M+ active accounts and global recognition, PayPal helps you reach more customers and boost sales.

higher checkout conversion with PayPal.²

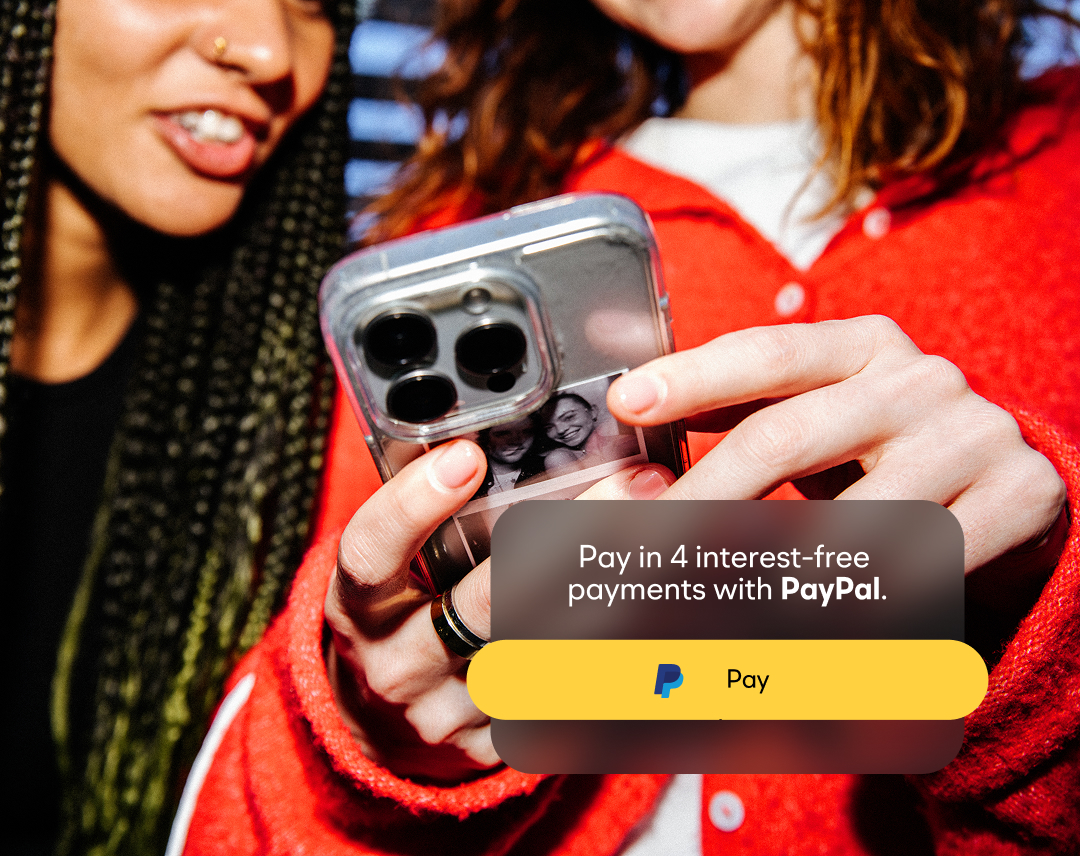

Power AOV with Pay Later

Offer Pay Later throughout the shopping journey. Customers pay over time. You get paid up front.

higher average order value with Pay Later.³

Reach younger Venmo shoppers

Connect with 95M active Venmo accounts to drive sales, with a payment method Gen Z and Millennials already use and trust.

overall Venmo conversion rate.⁵

Guest checkout that drives sales

Recognize shoppers, speed up guest checkout, and help boost conversion with Fastlane by PayPal.

higher conversion rate with Fastlane by PayPal.⁶

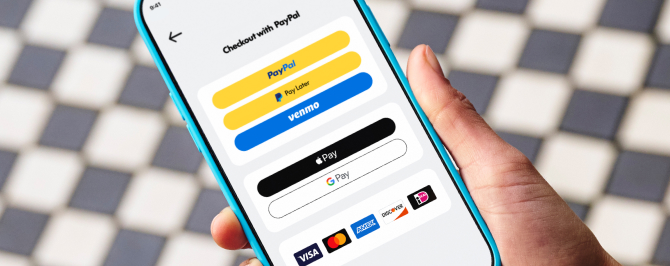

More ways to get paid. Fast.

All major credit and debit cards

Process major payment cards all in one place.

Apple Pay® and Google Pay™

No need to juggle multiple payment providers.

Local payment methods

Reach international shoppers with local payment methods.

Contactless payments

Get paid with a simple tap. Take sales straight from your phone.

PayPal Open helps your

business grow

Go global and make it local

Reach international customers in 200+ markets. Country-specific payment methods make every global transaction feel local.

Easy repeat purchases

Securely store payment details and help returning customers check out faster.

Offer flexible subscription plans

Set billing cycles and offer trial periods for a seamless checkout experience.

Package tracking

Access discounted rates and track every package in real time, all within your PayPal dashboard.

On an older version of PayPal?

Upgrade to the latest integration and offer your customer more ways to pay.

Get ahead

PayPal helps you run your business more efficiently by helping increase authorization rates and protecting against fraud.

Fraud protection

Keep your business and transactions secure with AI-powered fraud detection, encryption, and real-time monitoring. Seller Protection helps reduce fraudulent sales on all eligible transactions.⁷

Built-in compliance

PayPal supports cross-border trade for international payments and transfers.

Setup is simple

Step 1

Complete the registration form HERE

Our Account Manager will contact you to verify your information and assist with the KYC process. If you do not receive any contact within 48 hours, please send us a message.

Step 2

Register your PayPal account using the same email address provided in the form above, HERE

Step 3

Prepare your Business Registration, Identity Documents & Proof of Address to complete Account Opening & Due Diligence Process.

Already have PayPal?

.svg)

.svg)